If you are a company that has a consumer duty to consider the impact or harm, a risk will have on the company and your customers, this video will show you a free feature in Symbiant that easily resolves the problem.

Standard risk scoring is to take a measurement of the impact a risk will have on the company. However, as part of your consumer duty, you now have to consider the harm that risk will also have on your customers.

You could duplicate the risk to your risk registers and then re-score it based on the consumer impact, but this isn’t ideal, as you now have double the risks to manage.

When you turn on harm risk scoring in Symbiant, you get a new set of voting options, so you can consider and record how the risk will affect your customers.

When it comes to reporting you can include the harm so you can visualise it in the heat maps, you can even plot the average of both scores.

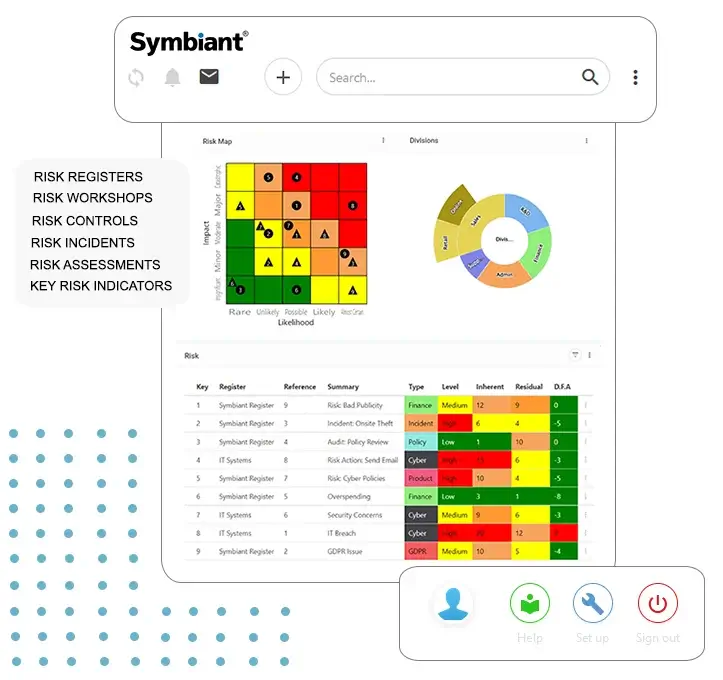

The Symbiant risk register module is part of the Symbiant one platform, where each module is only £100 per month.

To see more Risk Management Software solutions Click Here