Risk Management Software

Symbiant Risk Management Software Protects Objectives and Builds Resilience

Award-Winning GRC & Audit Software,

Trusted Since 1999 by

Reduced Risk Exposure, Strategically Aligned

Identify and prioritise the risks that truly threaten your objectives. Symbiant links risks to business goals, so you focus your efforts where they’ll have the biggest strategic impact.

Smarter, More Informed Control Investment

With clear visibility and optional AI-assisted scoring, you can confidently invest in the right controls. No more guesswork—just decisions backed by logic, context, and connected data.

Faster Incident Response. Greater Organisational Resilience

Respond and recover with speed and clarity. From root cause analysis to consequence prediction, Symbiant empowers your teams to act decisively and adapt quickly to change.

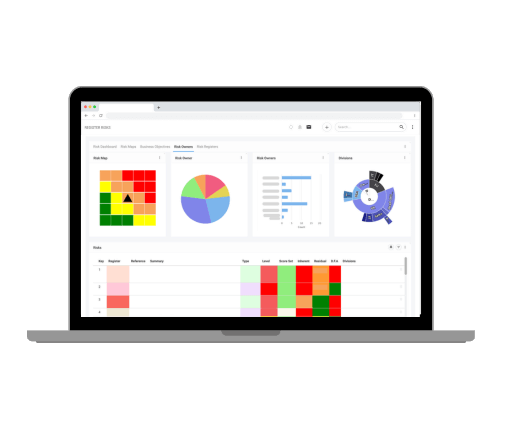

Symbiant Risk Management software

Simplify Risk Management With Agile, Easy-to-Embed Software Built for Real-World Needs

Symbiant’s Risk Management Software is intuitive, agile, and built to simplify the entire process. Fully modular and easy to embed, it adapts to your structure, scales with your organisation.

Your complete solution starts from just £300/month*.

Or start small with any single module from only £100/month*

You can mix and match any modules as your needs grow.

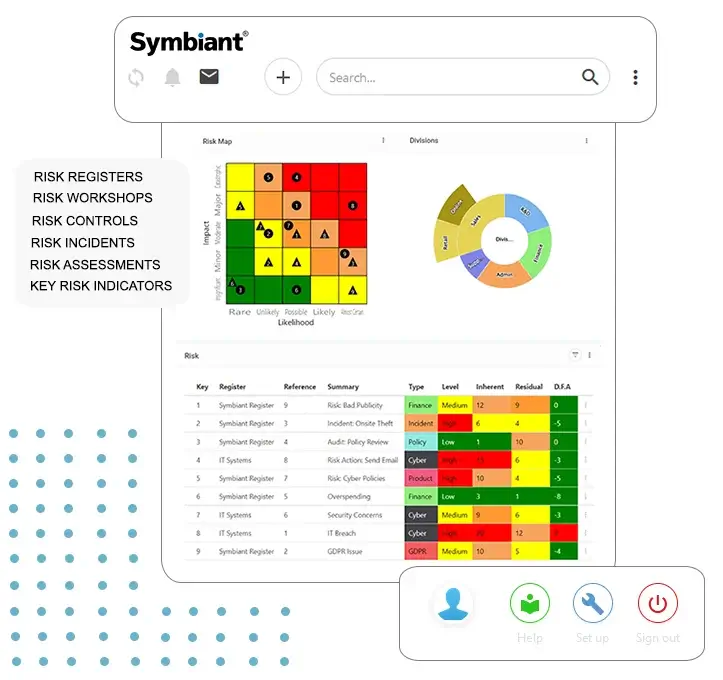

Risk Registers

Discover the Most Trusted Solution in Risk Management

Risk Workshops

Transforming Collaboration in Risk Management

Risk Incident Reporter

Streamlined Incident Management Made Easy

Risk Controls & Policies

Simplified, Comprehensive, and Effective

Risk Assessments

Tailored, Precise, and Insightful

Key Risk Indicators (KRI)

Proactive Risk Management Made Simple

Symbiant Risk Management software

All-in-One Risk Management Software, Tailored to Your Organisation

Enterprise Risk Management

Symbiant is cloud-based, modular, and ready to use—no training required. It’s intuitive by design and adapts to your structure.

All-in-One and Modular

Add modules like Audit, Compliance, and Incidents for just £100/month/module*. Built to support ISO 31000, ISO 27001, and ISO 27005, Symbiant scales with you.

Cross-Team Collaboration

Symbiant connects departments and encourages company-wide participation in risk. Increase visibility, accountability and collaboration.

Connected Risk Intelligence

Effortlessly Automated

Configure fields, workflows, reports, and permissions to suit your organisation’s unique needs. Stay ahead with real-time alerts, automated reminders, and up-to-date oversight.

Optional AI-Assistant

Risk Manager at your fingertip

Empowering Risk Managers with

AI-Assisted Precision

Symbiant’s optional AI Assistant is fully integrated and trained on real-world risk, audit, and compliance challenges. It keeps your data secure while uncovering hidden threats, identifying root causes, and predicting the consequences of control failures. By connecting data across functions, it reveals how risks may cascade—turning scattered information into clear, actionable insight.

Starting from just £100/month*

Unlimited users. Unlimited requests.

Streamlined Risk Management with Symbiant AI

Actionable Insights with Symbiant AI

Generate powerful, data-driven reports enriched with AI-recommended controls, root causes, and potential consequences. Symbiant AI not only scores risks—it reveals what’s driving them and what could happen if controls fail. Audit teams can instantly access every connected risk within a specific entity, eliminating manual searches and saving valuable time.

Maximise Time Efficiency

Save up to 90% of your time with automation, finding duplicate risk entries in seconds, refining poorly written data, rewriting risk descriptions for clarity, and automatically populating fields with details tailored to the risk and your business objectives.

Symbiant AI Predicts & Protects

It assess your current controls and their effectiveness, suggests improvements and recalculates residual risk scores for optimal mitigation.

Ensure Privacy and Security

Symbiant’s AI-Powered Assistant is fully GDPR-compliant and built to protect your privacy. It does not collect or store your data. Instead, it creates a temporary cache folder to fulfil each query and immediately deletes the information once the task is complete.

Your data always stays securely within your environment, giving you full control and peace of mind while benefiting from AI assisted insights.

Symbiant Risk Management software

Unlock Full Risk Management Potential

Symbiant’s Risk Management Software helps you achieve objectives, build resilience, and stay agile in a changing world. Fully customisable and easy to embed, it breaks down silos, supports ISO standards, and fits around your structure—so you can identify, assess, and manage risks with speed and clarity.

Explore powerful, integrated modules across governance, compliance, and audit—all from just £300/month.*

Your central hub for complete, connected risk visibility.

Symbiant Risk Management Module

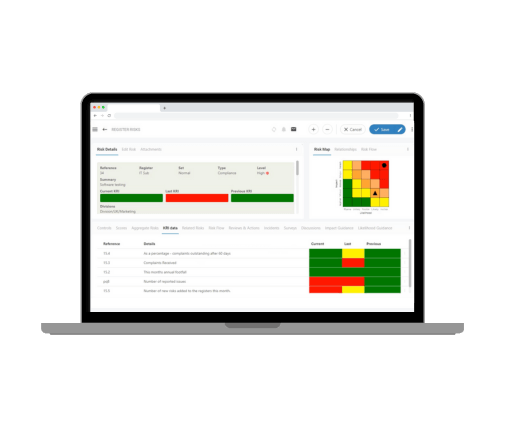

Symbiant’s Risk Register Software helps you achieve objectives, reduce exposure, and build resilience—without disrupting your existing setup.

It gives you a dynamic, visual way to manage, track, and report on risks across your organisation. It provides a comprehensive overview of risk exposure, allowing you to assess potential impacts with clarity and confidence.

Designed as the focal point of your GRC system, the module integrates seamlessly with other Symbiant modules—such as Audit, Controls, and Incidents—to deliver a holistic view of your entire risk landscape.

Align Risk Management with Business Objectives—Clearly and Confidently

Whether you’re managing operational, strategic, or compliance-related risks, the Risk Register Module gives you complete control to define, track, and structure risks around your business. With full flexibility to align risks to objectives, controls, and departments, you can ensure consistency, accountability, and a clear view of what matters most—without complexity.

Real-Time Residual Risk Scoring

Dynamic Risk Appetite Calculation

Quickly assess your organisation’s current risk appetite. It helps you understand tolerance thresholds in real time.

Risk Flow Visualisation (Domino Effect)

Audit & Compliance Integration

Dual-Mode Scoring: Qualitative & Quantitative

Multiplicative & Ranked Scoring Options

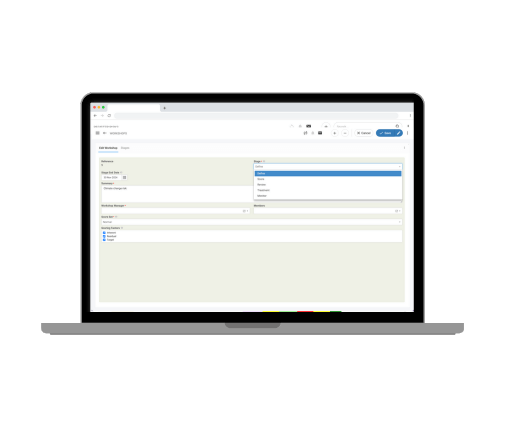

Transforming Collaboration in Risk Management

Risk Workshops Module

Symbiant’s Risk Workshops provide a virtual workspace for risk assessment—empowering all users, regardless of expertise, to collaboratively identify, assess, and manage risks.

Built to support ISO 31000 and ISO 27001 compliance, it helps strengthen controls, align departments, and safeguard business objectives. By removing barriers like distance and scheduling, it enables company-wide participation in a unified risk programme, enhancing compliance, improving decision-making, and driving strategic resilience.

How Symbiant’s Risk Workshops Streamline Collaborative Risk Assessment

Identify

Measure

Treat

Monitor

Assign action plans, track implementation, and link to the Risk Register

Completed workshops can be archived and reported on, offering a valuable reference for compliance and understanding why specific decisions were made.

Symbiant’s Risk Workshops remove barriers to participation, ensuring a streamlined, efficient, and compliant approach to risk management that drives better outcomes across your organisation.

Streamlined Incident Management

Risk Incident Reporter

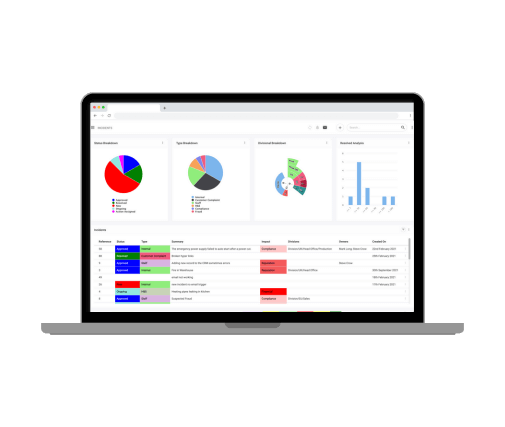

Symbiant’s Incident Reporting Module offers a streamlined, centralised solution for capturing and managing business-related incidents.

Whether simple or complex, reporting forms can be tailored by role or department—ensuring that every team can log incidents accurately, efficiently, and in a way that aligns with your organisation’s structure.

Whether used on its own or fully integrated with the Risk Register, Symbiant’s Incident Reporting Module ensures every incident or potential issue is accurately captured, effectively managed, and proactively resolved.

Streamlined, Integrated Incident Management Software

The Symbiant Risk Incident Reporter simplifies incident logging, tracking, and linking to risks and controls—helping organisations respond faster, uncover root causes, and strengthen resilience.

Dynamic Incident Analysis & Management

Actionable Tracking

Comprehensive Data Capture

Seamless Risk & Control Integration

Link incidents directly to risks and controls for a unified view of your organisation’s risk landscape.

Detailed Reporting of Incident Health

Customisable Workflows

Simplified, Comprehensive, and Effective

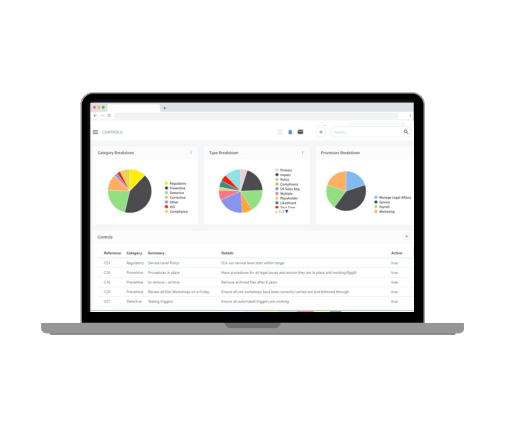

Risk Controls and Policies

Symbiant’s Controls and Policies Solution delivers an advanced, fully featured module designed to streamline control management—a critical component of risk management and a mandatory requirement for many industries.

With an intuitive interface and no complicated setup, the platform makes creating, actioning, and monitoring controls fast, efficient, and straightforward. Symbiant ensures that control management becomes a seamless part of your risk management strategy.

Streamline and Strengthen Your Controls with Symbiant

Symbiant’s Controls and Policies Solution delivers a comprehensive toolkit to streamline control management and enhance your organisation’s risk framework.

Real-Time Monitoring of Risk Exposure

Stay updated with live insights into how controls impact your risk exposure.

Integrated Control Policies

Seamlessly link controls with policies to ensure cohesive and streamlined management.

Control Weightings on Risk Scores

Factor control effectiveness into risk scores for more precise evaluations.

Risk Bowties

Visualise the relationships between risks, controls, and outcomes for enhanced clarity and decision-making.

Actionable Controls

Assign responsibilities, set deadlines, and attach essential documents to track control progress effectively.

Create & Schedule Control Assessments

Plan and execute control assessments to ensure ongoing effectiveness and alignment (requires Risk Assessments module).

Tailored, Precise, and Insightful

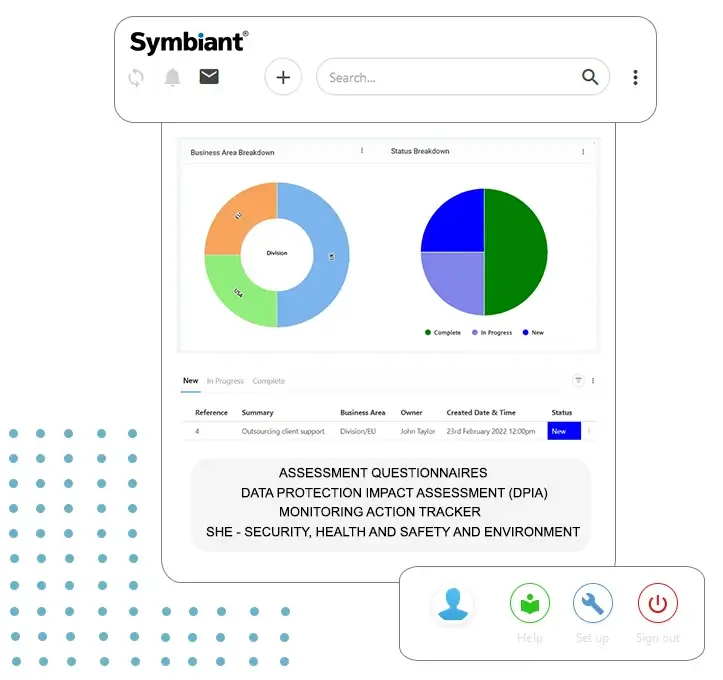

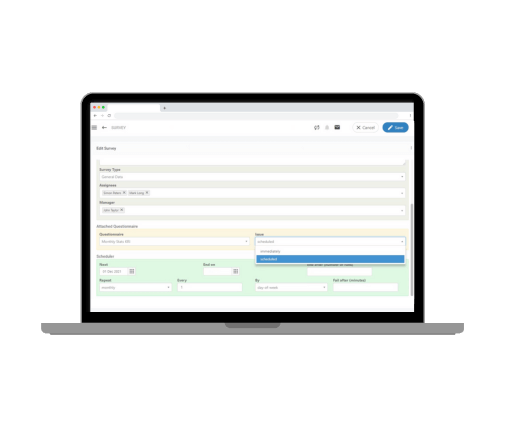

Questionnaires Survey and Assessment Software

Symbiant’s Risk Assessment Software empowers organisations to evaluate risks with accuracy and efficiency. Create custom questionnaires with advanced rules to ensure risks are reviewed thoroughly and align seamlessly with your processes.

The module also features Key Risk Indicator (KRI) capabilities, enabling you to identify and monitor potential pressures on risks through targeted assessments.

Tailored Tools for Smarter Risk Evaluation

Custom Questionnaires

Advanced Assessment Flow

Scheduled Assessments

Automate and plan risk assessments to ensure timely and consistent reviews.

Historical Tracking

KRI Questionnaires

Develop focused Key Risk Indicator assessments to identify potential risk strains.

Free feature

KRI - Key Risk Indicators

Symbiant’s Key Risk Indicator (KRI) feature empowers organisations with powerful tools to monitor the health of risk-related factors. Acting as early warning signals, KRIs help you identify and address potential issues before they escalate.

As a complimentary feature for all clients, KRIs are seamlessly integrated into questionnaires and risk registers, ensuring proactive risk management without additional cost.

Stay Ahead of Potential Risks

Symbiant’s KRI feature ensures your organisation stays proactive and prepared, enhancing your ability to manage risks effectively and efficiently.

Real-Time Monitoring

Keep a close eye on strained risks with live updates for timely interventions.

Multi-Risk Linking

Link KRIs to multiple risks for a comprehensive overview of interdependencies.

Historical Data Tracking

Access and analyse historical KRI values to uncover trends and support data-driven decisions.

25 Years. Thousands of Users. One Trusted Platform.

With over 25 years of innovation in Governance, Risk, and Compliance (GRC) and Audit Management, Symbiant is trusted by organisations across every sector. Our clients love how our powerful, affordable, award-winning and fully customisable risk software helps them stay compliant, make smarter decisions, and reduce complexity, without the costly overheads.

Hover to Explore our Solutions.

Symbiant

All-in-One GRC & Audit

Management Powerhouse

Symbiant’s flexible, modular platform streamlines governance, risk, compliance, and audit—so you can reduce complexity, adapt fast, and stay focused on achieving your objectives.

Our Solution at a Glance:

Risk Management Software

The Symbiant Risk Management Software module enables organisations to identify, understand, and manage risks with ease and efficiency. It provides a streamlined approach to monitoring, assessing, and mitigating risks, ensuring informed decisions and compliance.

AI-Powered Assistant

Symbiant AI connects data across your organisation, delivering actionable insights and seamless workflows. From logical, data-driven risk scoring to uncovering root causes and predicting the domino effect of control failures, Symbiant AI empowers smarter, faster decisions. Eliminate duplicate risks in seconds, refine controls, identify emerging risks, and so much more—all tailored to your business.

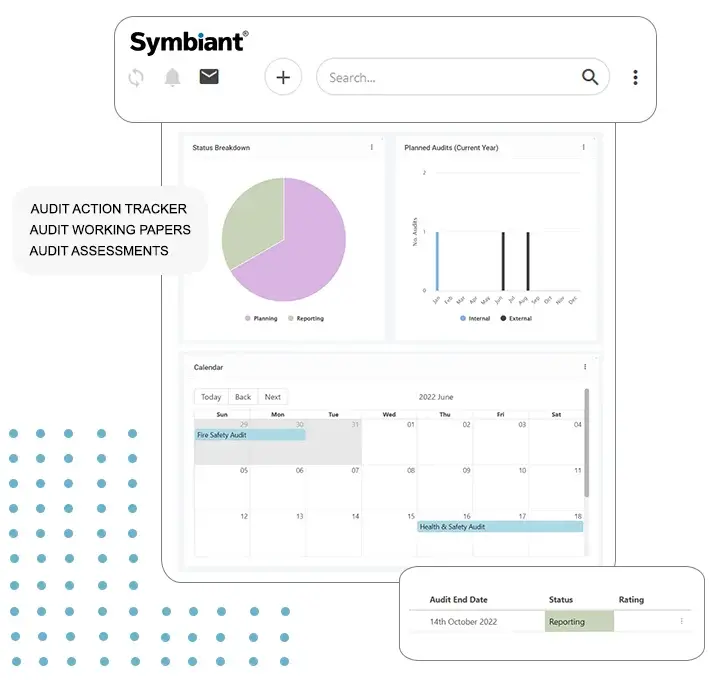

Audit Management Software

The Symbiant Audit Management Software module streamlines audit planning, action tracking, and time management. It automatically pulls relevant data, allows easy report customisation, and generates professional audit reports.

Compliance Management Software

The Symbiant Compliance Management Software module simplifies the management of compliance tasks. It helps organisations track regulations, manage audits, and ensure adherence to legal requirements, driving efficiency and minimising risk.

Risk Management Software

The Symbiant Risk Management Software module enables organisations to identify, understand, and manage risks with ease and efficiency. It provides a streamlined approach to monitoring, assessing, and mitigating risks, ensuring informed decisions and compliance.

AI-Powered Assistant

Symbiant AI connects data across your organisation, delivering actionable insights and seamless workflows. From logical, data-driven risk scoring to uncovering root causes and predicting the domino effect of control failures, Symbiant AI empowers smarter, faster decisions. Eliminate duplicate risks in seconds, refine controls, identify emerging risks, and so much more—all tailored to your business.

Audit Management Software

The Symbiant Audit Management Software module streamlines audit planning, action tracking, and time management. It automatically pulls relevant data, allows easy report customisation, and generates professional audit reports.

Compliance Management Software

The Symbiant Compliance Management Software module simplifies the management of compliance tasks. It helps organisations track regulations, manage audits, and ensure adherence to legal requirements, driving efficiency and minimising risk.

Pricing Disclaimer

GRC4.00 Agile GRC

Agile GRC solution that is highly intuitive, configurable, and engaging systems for front-end to back-office risk functions.

Symbiant’s AI-Assisted Risk Management Software provides a comprehensive, agile, and highly affordable Governance, Risk, Compliance (GRC) and Audit solution designed for every organisation, from major enterprises to non-profit charities. Trusted globally since 1999 with over 25 years of expertise, Symbiant leads in delivering effective, resilient, and agile risk management capabilities.

Our AI-Assisted Risk Management Software empowers businesses to go beyond basic compliance, ensuring measurable risk reduction and enhanced organisational resilience. The intuitive, configurable platform supports strategic decision-making by providing real-time, holistic visibility of your risk posture, fostering strategic agility in a constantly evolving landscape.

Core components and modules of Symbiant’s Risk Management Solution include:

- Risk Registers: Centralised risk management system for identifying, assessing, and monitoring all organisational risks. Fully customisable, integrating seamlessly for a unified, real-time view of your risk landscape. Supports frameworks like ISO 31000, ISO 27001, and ISO 27005.

- Risk Workshops: A digital workspace promoting collaboration anytime, anywhere. This module facilitates risk identification, assessment, and treatment across departments. Promotes enterprise-wide engagement in risk management programmes, improving decision-making and compliance.

- Risk Incident Reporter: Streamlined incident management software for logging, actioning, and linking incidents directly to corresponding risks and controls. Essential for incident response, crisis management, and strengthening governance strategies, ensuring quick containment and recovery.

- Risk Controls & Policies: Advanced module for comprehensive control management. Link controls to risks for real-time residual risk scoring, monitor performance, and enforce compliance policies. Essential for effective risk mitigation and demonstrating accountability.

- Risk Assessments: Tools for conducting tailored, precise, and insightful risk evaluations. Create custom questionnaires, use advanced rules, and schedule automated assessments to identify potential pressures and ensure thorough risk review.

- Key Risk Indicators (KRIs): Powerful, complimentary feature acting as early warning signals for proactive risk management. Monitor the health of risk-related factors, link to multiple risks, and integrate with questionnaires and risk registers for timely interventions.

Symbiant’s AI Assistant enhances these modules by providing intelligent data linking, connecting risks to business objectives, controls, incidents, and audit processes. It enables logical, data-driven risk scoring (replacing subjective assessments), performs root cause and consequence analysis, detects duplicate data (saving up to 90% time), uncovers an enhanced risk universe including emerging threats, and provides AI-enhanced risk refinement and mitigation strategies. The AI also revolutionises incident management by optimising control suggestions and improving resolution efforts.

Symbiant is engineered as the most affordable yet robust GRC and audit platform, starting at just £100 per month with unlimited users. Our solution is agile and scalable, proven by its adoption by major enterprises to small businesses and non-profit charities worldwide.

Data privacy and security are paramount; Symbiant AI processes data temporarily, never uses organisational data for AI model training, and is fully GDPR compliant.

This comprehensive risk management solution fosters superior organisational resilience, enables strategic agility, and drives overall GRC effectiveness, ensuring your business reliably achieves its objectives.