In the intricate decision-making landscape, the idiosyncratic nature of risk assessment often introduces a challenging dimension to strategic planning. Risk subjectivity, the inherent tendency for individuals or teams to interpret and evaluate risks with varying perspectives, stands as a silent but formidable influencer in the dynamics of organisational strategy. Unravelling the complexity of this phenomenon and comprehending its implications is vital in fortifying the foundations of sound risk management. This comprehensive guide aims to illuminate the essence of risk subjectivity: its manifestations, common triggers, the substantial issues it introduces into the fabric of organisations, and the strategic methodologies that can be adopted to counter its potentially adverse effects. By scrutinising this often-overlooked aspect, businesses and decision-makers can navigate through the labyrinth of uncertainty with more assured and informed approaches.

What is Risk Subjectivity?

Risk subjectivity is the idea that individuals perceive and evaluate risks differently based on their experiences, beliefs, and values. It acknowledges that what one person considers risky might not be perceived as such by another due to varying perspectives and subjective interpretations.

What Influences Risk Subjectivity?

- Cultural Influences: Cultural backgrounds significantly shape how individuals perceive risk. What might be deemed acceptable or risky in one culture could be entirely different in another.

- Personal Experience: Past experiences with similar situations can heavily influence how a person assesses risks. Positive or negative encounters can shape their risk tolerance and perception.

- Cognitive Biases: Human beings are prone to cognitive biases, which can affect risk perception. Factors like availability bias (judging based on easily available information) and anchoring (relying too heavily on the first piece of information) can skew risk assessments.

- Emotional and Psychological Factors: Emotions, fears, and psychological traits impact how individuals perceive and react to risks. Some may be more risk-averse due to anxiety or fear, while others might be more risk-tolerant.

- Information and Knowledge: Access to information and one’s knowledge about a particular risk significantly affect how it’s perceived. Lack of information or misinformation can lead to skewed risk assessments.

Understanding risk subjectivity is crucial in various fields, such as finance, health, and policy-making. Recognising that different people view risks differently helps in developing more comprehensive risk management strategies that accommodate various perspectives.

The Potential Impacts of Risk Subjectivity

- Inaccurate Risk Assessment: Different perceptions of risks can lead to erroneous risk assessments. Some risks might be overestimated, leading to excessive precautions or missed opportunities, while others might be underestimated, leading to unexpected negative consequences.

- Decision-Making Biases: Subjective perceptions can introduce biases in decision-making. This can lead to decisions that might not be aligned with the actual level of risk, potentially resulting in poor choices or missed opportunities.

- Increased Vulnerability: When certain risks are downplayed due to subjective perceptions, it can leave organisations or individuals more vulnerable to unforeseen events or threats.

- Conflict and Misunderstandings: Differences in risk perception among individuals or groups within an organisation can lead to conflicts or misunderstandings. Disagreements on risk evaluation can hinder effective collaboration and decision-making.

- Failure to Adapt: Over-reliance on subjective risk assessments might lead to a failure to adapt to changing circumstances or new information. This inflexibility can be detrimental when faced with evolving risks or challenges.

- Financial Impacts: Incorrect risk perception can have financial implications. It might lead to misallocation of resources, excessive spending on unnecessary precautions, or insufficient investment in managing actual risks.

- Loss of Opportunities: Overly risk-averse perspectives might lead to missed opportunities for growth or innovation. Subjective risk aversion could inhibit taking calculated risks that could lead to progress.

- Reputation Damage: Inadequate risk assessment and management due to subjective biases can damage an organisation’s reputation. If risks materialise and cause harm, it can lead to loss of trust and credibility.

Understanding and mitigating the effects of risk subjectivity is crucial for making informed decisions, managing risks effectively, and promoting growth while minimising potential negative impacts.

How Can Organisations Combat Risk Subjectivity?

- Diverse Perspectives: Encourage diverse teams and viewpoints. Different backgrounds and experiences bring varied risk perceptions, leading to more comprehensive risk assessments.

- Clear Communication: Provide clear and accurate information about risks. Misinformation or lack of information can exacerbate subjective perceptions.

- Training and Education: Offer training programs that help individuals understand cognitive biases and psychological influences on risk assessment. Educating employees about these factors can aid in more objective risk evaluations.

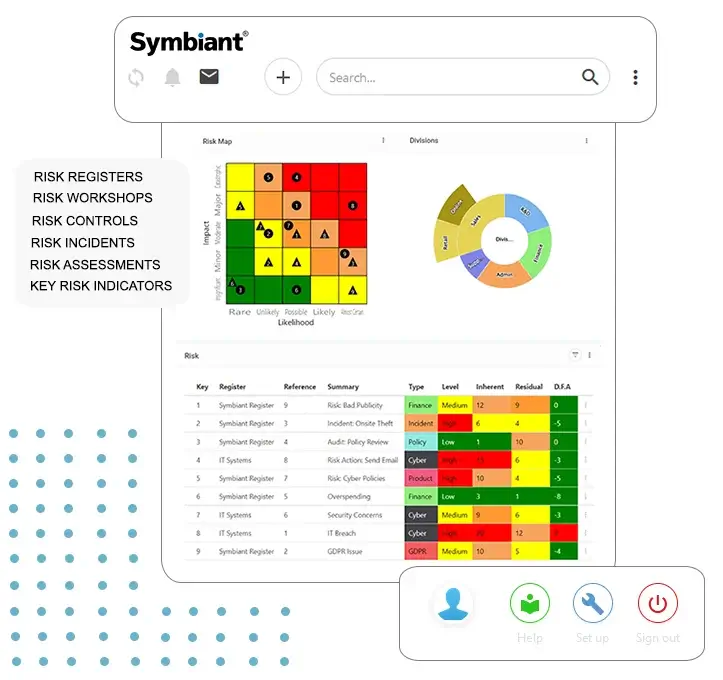

- Data-Driven Approach: Implement a data-driven risk assessment process. Utilise historical data and analytics to support decision-making. Objective data analysis can help mitigate the impact of subjective opinions.

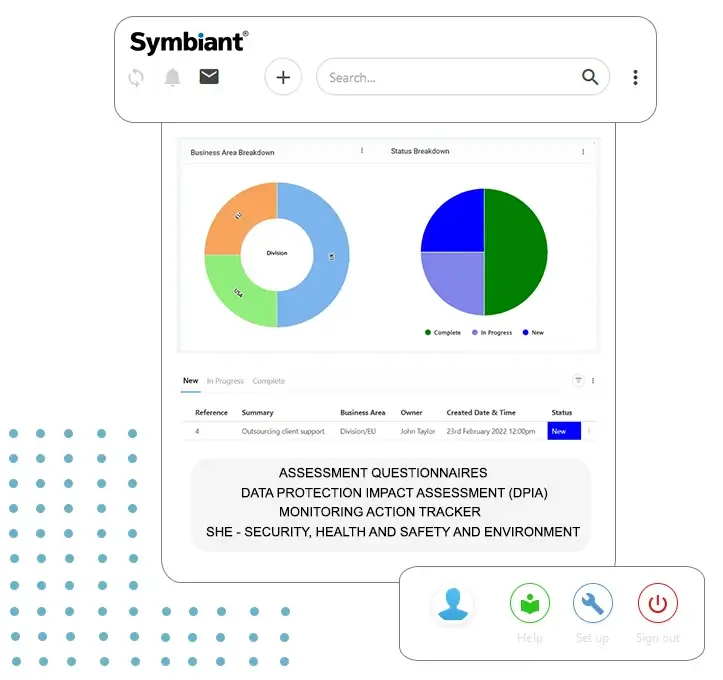

- Risk Management Frameworks: Implement standardised risk management frameworks that guide risk assessment and decision-making processes. These frameworks can help in structuring and objectively evaluating risks.

- Risk Tolerance Guidelines: Define clear risk tolerance levels and parameters. This helps in setting a common understanding of what is an acceptable level of risk within the organisation.

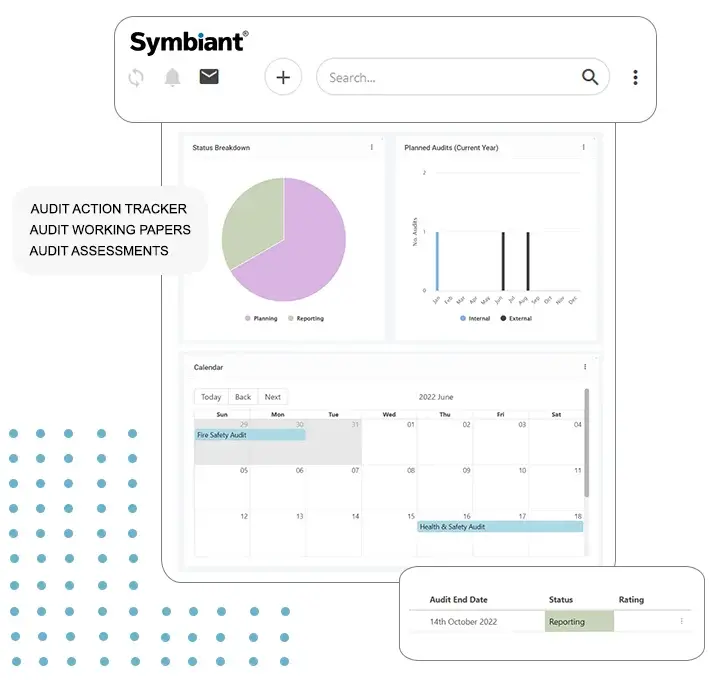

- Regular Reviews and Audits: Regularly review and audit risk assessment processes. This ensures that the approach remains updated, relevant, and effective in addressing evolving risk scenarios.

- Encourage Constructive Debate: Foster an environment where constructive debate and discussion about risks are encouraged. Allowing individuals to express their opinions can highlight diverse perspectives and potentially identify blind spots.

- Leadership Support: Ensure that leadership promotes and supports a culture that values objective risk assessment and decision-making. Leaders play a pivotal role in shaping the risk culture within an organisation.

By employing these strategies, organisations can minimise the impact of subjective risk perceptions, leading to more objective and comprehensive risk management practices.

Summary

Risk subjectivity encapsulates how individuals perceive and evaluate risks due to personal experiences, cultural influences, cognitive biases, and emotional factors. This subjective nature often leads to varied interpretations and assessments of risks. It influences decision-making processes within organisations and personal contexts, potentially resulting in inaccurate risk assessments, biases in decision-making, increased vulnerability to unforeseen events, conflicts due to differing perceptions, and missed opportunities. Recognising and addressing these subjective biases is vital in developing comprehensive risk management strategies that balance different perspectives to make more informed and objective decisions.

We have a shorter graphic discussing the topic of Risk Subjectivity on our LinkedIn you can read and share it here: