Symbiant's Operational Resilience and Business Continuity software

The Complete Guide to Operational Resilience and Business Continuity with Symbiant

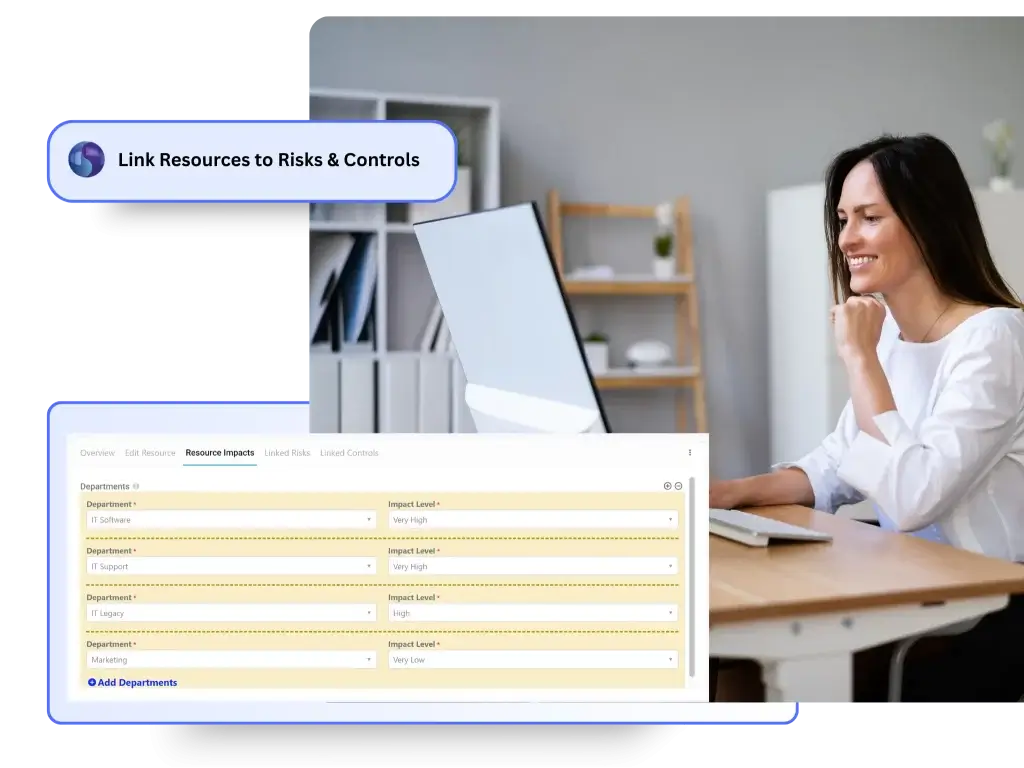

Symbiant’s Operational Resilience and Business Continuity Management (BCM) Software strengthens your organisation’s ability to anticipate, withstand, and recover from disruption, all while learning and improving with every event. Designed for regulatory alignment and built for real-world use, it gives you the clarity, agility, and structure needed to protect customers, operations, and reputation.

Award-Winning GRC & Audit Software, Trusted Since 1999 by Companies of All Sizes

Independent Government Feedback

Outstanding User Satisfaction with Symbiant's GRC, Risk Management and Audit Software

Independent results from a government-led survey demonstrates a level of trust and satisfaction that is exceptional in the GRC sector, reinforcing Symbiant’s position as a proven, reliable, and governance-ready solution for organisations with serious assurance responsibilities.

450

Survey Participants

95%

Users were satisfied or

better with the system as a whole

97%

Users were satisfied or

better with the support

Symbiant ERM Solution

Why Operational Resilience Matters More Than Ever

In recent years, operational resilience has become one of the most discussed topics in enterprise risk and compliance circles. The growing likelihood and impact of major shocks, from cyber incidents to geopolitical volatility, combined with regulatory scrutiny from bodies like the FCA, PRA, and Bank of England, has pushed operational resilience to the top of the corporate agenda.

At first glance, it might appear to be a new concept or simply a rebranding of business continuity management (BCM) and disaster recovery (DR). In reality, operational resilience builds on these established disciplines while expanding their scope and purpose.

The term resilience originates from the Latin word resilire, meaning to recoil or rebound. This captures the essence of resilience, the ability to bend without breaking, to absorb impact, and to rebound stronger.

Formal Definitions of Operational Resilience

Different standards provide complementary perspectives:

ISO 22316 (2017): Security and Resilience – Organisational Resilience, Principles and Attributes

“The ability of an organisation to absorb and adapt in a changing environment.”

Basel Committee on Banking Supervision (2021): Principles for Operational Resilience

“The ability of a bank to deliver critical operations through disruption.”

While ISO 22316 focuses on resilience in all organisational contexts, the Basel definition specifically addresses continuity within the financial sector — aligning closely with today’s FCA and PRA Operational Resilience Framework.

what resilience really means in practice.

The Core of Operational Resilience

The formal definitions highlight that resilience is not just about recovery; it’s about readiness, response, and reinvention.

In essence, operational resilience is the ability to absorb shocks, maintain critical operations, and adapt to a new normal — all while protecting customers, stakeholders, and reputation.

Unlike traditional business continuity management (BCM) or disaster recovery (DR), operational resilience takes a broader, enterprise-wide view. It connects governance, risk, and continuity across the organisation, ensuring that every part of the business contributes to stability and confidence.

Symbiant helps operationalise this vision by bringing risk, continuity, and compliance together in one connected GRC ecosystem.

Every resilient organisation builds around five interconnected pillars that turn strategy into action:

- Prevention – Identify and mitigate threats before they escalate.

- Robustness – Strengthen systems, infrastructure, and controls to minimise impact.

- Recovery – Ensure continuity with tested recovery plans and clearly defined impact tolerances.

- Adaptation – Respond effectively to new conditions or permanent changes after disruption.

- Learning – Analyse events, apply insights, and continuously enhance your organisation’s readiness.

For example, in the face of a major event such as a cyber breach or earthquake:

- Prevention means identifying vulnerabilities and reinforcing defences.

- Robustness ensures strong internal safeguards.

- Recovery focuses on restoring operations within tolerance.

- Adaptation involves adjusting business models or systems for long-term change.

- Learning embeds insights into future strategies.

Together, these principles ensure you can prepare, withstand, recover, and evolve — even under “severe but plausible” conditions.

The Five Pillars and Drivers of Resilience

A continuous cycle of prevention, response, and improvement.

Why resilience is now a strategic necessity.

The Drivers Behind Modern Resilience

Operational resilience has become a board-level priority due to:

- Evolving risk environments – Increasing cyber threats, supply chain dependencies, and climate-related risks.

- Regulatory requirements – FCA, PRA, and DORA frameworks mandating evidence of impact tolerance and service continuity.

- Customer and investor expectations – Heightened focus on transparency, dependability, and responsible governance.

With Symbiant’s Operational Resilience and BCM Software, organisations can strengthen each pillar, preventing disruption, managing impact, and demonstrating measurable resilience across all operations.

Where They Overlap

Focus on ensuring that critical services continue during and after disruption.

Depend on risk assessment, testing, and planning to minimise downtime.

Depend on risk assessment, testing, and planning to minimise downtime.

In other words, BCM and operational resilience share the same goal: maintaining confidence and continuity — even under pressure.

Two disciplines. One shared purpose: continuity and confidence.

Operational Resilience vs Business Continuity Management (BCM)

While operational resilience and business continuity management (BCM) are often discussed together, they are not the same thing. Both aim to protect critical operations, but they approach resilience from different perspectives — one strategic, one operational.

Why resilience is now a strategic necessity.

Where They Differ

| Aspect | Business Continuity Management (BCM) | Operational Resilience |

|---|---|---|

| Scope | Concentrates on internal operations, addressing physical or IT disruptions that affect the organisation’s ability to function. | Takes a broader, end-to-end perspective, considering how disruptions affect not only the organisation but also its customers, partners, and external stakeholders. |

| Focus | Primarily reactive, focused on recovery once disruption occurs through continuity and disaster recovery plans. | Proactive and preventative, designed to withstand, adapt, and evolve before and after disruption. |

| Integration | Often sits within individual business units, focused on internal dependencies and recovery times. | Integrates across the enterprise — linking risk, compliance, continuity, and third-party oversight for a unified resilience strategy. |

| Regulatory Context | Aligns closely with ISO 22301 and internal business continuity frameworks. | Aligned with FCA, PRA, and DORA operational resilience requirements, ensuring continuity of important business services (IBS). |

BCM is your foundation — operational resilience is your evolution.

A Connected Approach

Operational resilience doesn’t replace BCM — it enhances it.

It builds on continuity planning by adding prevention, adaptability, and stakeholder focus, helping organisations not just recover, but anticipate and evolve.

With Symbiant’s Operational Resilience and BCM Software, you can:

- Integrate risk, continuity, and compliance within a single system.

- Automate impact tolerance testing, reporting, and assurance tracking for FCA and PRA alignment.

- Strengthen prevention and recovery through real-time analytics, scenario testing, and cross-module intelligence.

The result? Complete visibility, faster recovery, and a culture of resilience that protects your organisation and its reputation.

Why proactive resilience matters more than ever.

Managing the Risk of Disruptive Events

Many organisations still fall into the trap of optimistic bias, the belief that “it won’t happen to us.” This mindset leads to underinvestment in resilience and leaves businesses reacting to crises rather than preparing for them.

The cost of reactivity is enormous.

The World Economic Forum estimated that fighting COVID-19 cost 500 times more than pandemic prevention measures would have. In other words, every $1 spent on prevention saves $500 in recovery.

This principle applies universally: across supply chains, critical infrastructure, and digital ecosystems.

Governments and global corporations alike have recognised the need to rebuild resilience through strategies such as onshoring, supply chain diversification, and technological redundancy to avoid the cascading disruptions experienced during recent crises.

Resilience isn’t just smart — it’s a duty.

A Call to the Risk Management Profession

The risk management community has a critical role to play in addressing regression to the tail.

We must drive awareness, influence organisational investment, and help shift from reactive responses to proactive resilience-building.

This means:

- Embedding resilience planning into enterprise risk frameworks.

- Using data-driven foresight to anticipate and mitigate future shocks.

- Investing in connected GRC systems that make resilience measurable and actionable.

The next era of risk management is not about predicting every event, it’s about building organisations capable of withstanding any event.

With Symbiant’s Operational Resilience and Business Continuity Software, risk managers gain the visibility, analytics, and automation needed to anticipate disruption, coordinate responses, and strengthen resilience — before it’s tested.

From the UK to the US and beyond — regulators are making resilience mandatory.

Global Regulatory Focus on Operational Resilience

As operational resilience becomes a global priority, regulators across financial and critical sectors are introducing frameworks to ensure organisations can withstand, recover, and learn from disruption.

These frameworks share common themes — from third-party risk oversight and scenario testing to cyber resilience and governance — signalling a shift from reactive continuity to proactive resilience-by-design.

United Kingdom (UK)

The UK has been the global pioneer in operational resilience regulation, driven by the Bank of England (BoE), Financial Conduct Authority (FCA), and Prudential Regulation Authority (PRA).

Operational resilience requirements came into effect in March 2022, with full enforcement in March 2025.

Firms must:

- Identify Important Business Services (IBS).

- Set impact tolerances.

- Develop and test plans to ensure critical services remain within those tolerances.

- Recent FCA updates also focus on Critical Third Parties (CTPs), particularly cloud service providers, to address concentration risk and ensure contracts include resilience obligations.

Additionally, the UK Corporate Governance Code’s Provision 29, effective from January 2026, reinforces the importance of operational resilience at the board level.

Provision 29 requires directors to monitor and assess the effectiveness of their company’s risk management and internal control systems — ensuring oversight of resilience is continuous, documented, and demonstrable.

Together, the FCA/PRA Operational Resilience Framework and Provision 29 establish a powerful foundation for risk visibility, governance, and accountability across UK organisations.

United States (USA)

Operational resilience in the US is guided by multiple agencies, including the Federal Reserve, Office of the Comptroller of the Currency (OCC), and Federal Deposit Insurance Corporation (FDIC).

The SR 20-24 guidance (2020) consolidates best practices for strengthening resilience across governance, operational risk management, third-party oversight, and cybersecurity.

Key areas include:

Identifying dependencies on critical vendors.

Including them in continuity and recovery planning.

Conducting regular scenario analysis.

Aligning with the NIST Cybersecurity Framework for ICT resilience.

European Union (EU)

The Digital Operational Resilience Act (DORA), effective January 2023, is the EU’s comprehensive resilience framework for financial entities and ICT service providers.

DORA mandates:

Integration of ICT risk management into governance.

Incident reporting and resilience testing.

Maintaining a register of ICT third parties.

All firms must be fully compliant by January 2025.

DORA also requires critical ICT providers to have EU-based subsidiaries for regulatory oversight — reinforcing accountability and local control.

Australia

The Australian Prudential Regulation Authority (APRA) is strengthening its operational resilience focus through Prudential Standard CPS 230, coming into effect July 2025 – 2026.

CPS 230 replaces legacy continuity and outsourcing standards with a principles-based framework that requires:

Mapping of critical operations.

Enhanced controls management.

Resilient third-party arrangements.

Australia’s Security of Critical Infrastructure (SOCI) Act 2018 further complements this with requirements for categorising, registering, and securing critical infrastructure assets across cyber, physical, people, and supply-chain domains.

Rest of the World

Other major jurisdictions are following suit, many aligning closely with UK and EU frameworks:

Singapore: The Monetary Authority of Singapore (MAS) embeds operational resilience principles in its Business Continuity Management (BCM) guidelines — emphasising dependency mapping, testing, and third-party resilience.

Hong Kong: The Hong Kong Monetary Authority (HKMA) issued resilience guidelines in 2022, requiring firms to map critical operations and complete resilience testing within three years.

Canada: The Office of the Superintendent of Financial Institutions (OSFI) released E-21 Operational Risk and Resilience guidelines in 2024, focusing on third-party risk, cyber resilience, and continuity — closely mirroring UK and Basel principles.

Integrating Operational Resilience Into Your Enterprise Risk Management (ERM) Framework

One of the biggest risks to operational resilience success is treating it as a new, standalone process — or worse, simply rebranding existing business continuity or disaster recovery plans.

Both approaches create confusion, duplication, and silos.

To build a truly resilient organisation, operational resilience must be integrated within your Enterprise Risk Management (ERM) framework.

This ensures that risk, resilience, and governance all flow through a single connected system — delivering better insight, efficiency, and board-level alignment.

By embedding operational resilience into your existing ERM framework, you:

- Maximise leverage – Build upon existing risk structures rather than starting from scratch.

- Reduce cost and complexity – Extend current systems and data instead of duplicating them.

- Increase board engagement – Position resilience as an enhancement, not another major project.

- Integrated resilience transforms fragmented processes into a unified, measurable, and strategic advantage.

ERM and Operational Resilience: A Unified Framework

| Feature | Enterprise Risk Management (ERM) | Operational Resilience |

|---|---|---|

| Link with Strategy and Objectives | ERM starts with corporate strategy and objectives — identifying risks that could prevent their achievement. | Resilience begins with understanding how objectives and services affect stakeholders, ensuring continuity of delivery. |

| Important Business Services (IBS) | Risks are assessed based on how they may disrupt critical processes that support strategic goals. | Identifies and maps important business services to critical sub-processes that directly impact customers and partners. |

| Risk Assessment | Risks are evaluated using indicators, metrics, and assessments to understand likelihood and impact. | Maps and assesses the resilience of key resources — people, systems, and suppliers — to determine overall operational health. |

| Continuity and Incident Management | BCM, DR, contingency, and incident management are part of the ERM response cycle. | Uses those same plans to validate whether operations remain within defined impact tolerances during resilience testing. |

| Scenario Analysis / Stress Testing | Scenarios are used to test how severe events affect objectives and processes. | Applies the same scenarios to resilience maps to ensure tolerances are met under stress. |

| Issues and Actions Management | Identifies, tracks, and resolves control failures and emerging risks. | Highlights resilience gaps, assigns actions, and tracks remediation progress to completion. |

| Cyber Risk and Security | Cyber risk forms part of enterprise-level risk registers and mitigation plans. | Cyber incidents are treated as critical disruptive scenarios within resilience mapping and testing. |

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

” We have had nothing but good experiences and we have a very strong relationship with the team at Symbiant. We continue to use Symbiant for a few reasons. 1. Cost – I don’t know of a GRC solution as broad as ours for a similar price. 2. Customisation – we are able to make changes to have the system look, feel, and run to our requirements with ease. 3. Support – the team at Symbiant Support are friendly, knowledgeable, understanding, and quick to respond.”

” We have had nothing but good experiences and we have a very strong relationship with the team at Symbiant. We continue to use Symbiant for a few reasons. 1. Cost – I don’t know of a GRC solution as broad as ours for a similar price. 2. Customisation – we are able to make changes to have the system look, feel, and run to our requirements with ease. 3. Support – the team at Symbiant Support are friendly, knowledgeable, understanding, and quick to respond.” ”Before we moved to Symbiant, we were spreadsheet-based, which was a very manual and time-consuming process […]. We also had a bespoke ‘waterfall report’ made to show changes in risk scores month by month — it makes it very clear to see any changes over the last six months.”

”Before we moved to Symbiant, we were spreadsheet-based, which was a very manual and time-consuming process […]. We also had a bespoke ‘waterfall report’ made to show changes in risk scores month by month — it makes it very clear to see any changes over the last six months.”